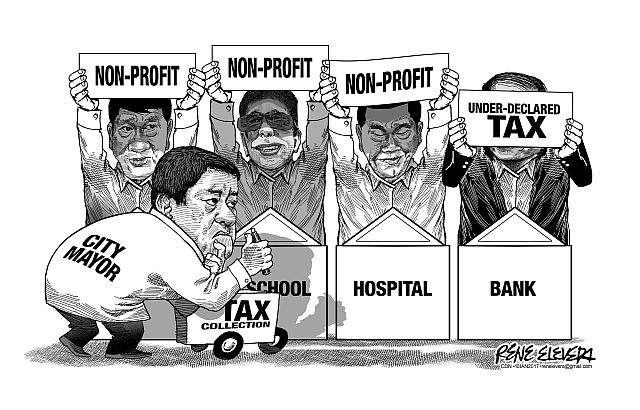

To be sure, Cebu City Mayor Tomas Osmeña’s crackdown on institutions he suspects have skipped on paying taxes to the city isn’t a new thing especially to those familiar with his decades-long rule.

There is that tax dispute with several schools and hospitals pending in the courts whom the mayor accused of paying less that what they owe to the city even with the city picking up their garbage and securing their premises with the police.

The schools and hospitals in question cited in their defense that they were non-profit which gives them some tax leeway but after sometime they are working out a deal to settle their tax obligations to the city.

Now the mayor is at it again, his sights set on three banks—East West Bank, Bank of the Philippine Islands and Banco de Oro—and his office plans to file charges against them for supposedly under declaring their annual gross receipts that they will include as part of their application for renewal of business permits.

The mayor’s threat to reject their business permit applications somewhat rekindled bad memories for certain businesses that were sympathetic to his erstwhile protege and now political rival, former mayor Michael Rama.

In fact not a few of those businesses supported Rama’s narrow re-election victory over Osmeña, encouraging investors like SM, Ayala and Filinvest to pursue their expansion plans at the South Road Properties (SRP) under the former mayor’s auspices over Osmeña’s vehement objections.

For while the mayor may cite under declared gross receipts as the main reason for cracking down on these banks, the underlying rationale seething beneath his intensified legal actions lie on the SRP deal entered into by the banks’s parent companies, in this case Banco de Oro being part of SM and Bank of the Philippine Islands owned by the Ayala Group.

The mayor’s office may produce adequate evidence that would warrant the filing of cases and even a rejection of the renewal of business applications by these banks but do we see the banks closing down anytime soon?

That would be unlikely given how it would impact on the local banking community but it does send disturbing signals to them and by extension, other investors which Osmeña, true to his nature, chooses to ignore and justify by saying that he’s doing it for the city residents.

That same rationale is also used to question the banking community on the recent scam that resulted in the theft of thousands of pesos from ATM card holders, who happen to include the mayor and Councilor Dave Tumulak.

Whether or not the mayor’s crackdown or shakedown (as his critics would describe it) of the three banks would bear fruit or lead to some commercial establishments being more honest in their dealings with the city remains to be seen.

Disclaimer: The comments uploaded on this site do not necessarily represent or reflect the views of management and owner of Cebudailynews. We reserve the right to exclude comments that we deem to be inconsistent with our editorial standards.