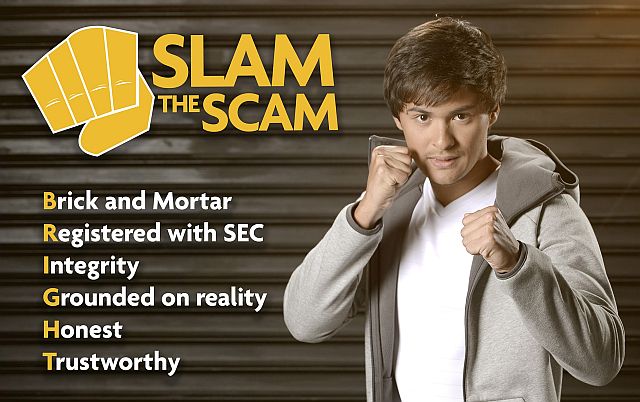

Matteo Guidicelli, financial literacy advocate through Sun Life Asset Management Company. Inc (SLAMCI), which is taking stand against investment scams by launching a multimedia campaign dubbed “Slam the Scam.”

AT 25, actor Matteo Guidicelli has already made significant strides in his career. The young man with Cebuano roots initially wanted to pursue a racing career but then took another career path and is now known as an actor, singer and triathlete.

Last year, he assumed another role as a financial literacy advocate of Sun Life Asset Management Company Inc. (SLAMCI) to encourage people his age to invest in mutual funds and ensure financial security.

Guidicelli credits his father for instilling in him the discipline to manage his finances well.

“I used to spend a lot, sometimes I like to splurge. But my father was a realistic guy. My father always told me to mind my numbers after what I received from my endorsements, my talent fees, “ he said in an interview after a SLAMCI press conference last Feb 8 at the Laguna Garden Café.

He added that because of his father’s constant drilling about “minding my numbers,” at age 18 he already knew the importance of managing his finances.

Guidicelli was in Cebu to help spread the word about the Sun Life Prosperity Card which is a gift card worth P5,000. It can be invested in any of the peso-denominated mutual funds managed by SLAMCI.

These peso-denominated funds are money market, government securities, bond fund, balanced fund, index fund and equity fund. Investing in any of these funds depends on one’s risk appetite. Bond fund, government securities and balanced fund are conservative fund investments while the most aggressive fund is the equity fund because it fluctuates the most.

The Prosperity Card is a perfect gift for birthdays, graduations, weddings, baptism and other special occasions. It can be purchased online at sunlifeprosperity.com.ph, from Sun Life financial stores or with a Sun Life advisor. Activating it can be done online by filling up and uploading forms, visit a Sun Life Customer Center or through a Sun Life advisor.

The pre-paid Prosperity Card was also introduced as a way to fight off investment scams that duped a lot of people including celebrities. Guidicelli also revealed that he is giving Prosperity cards to two Cebuano triathletes under his Sports foundation. They are Joseph Miller and Elmo Caraval.

Meanwhile, Guidicelli said, “When I was younger, I was threatened by the thought of investing.

I thought it needed big money. But with Sun Life you only need P5,000 to start an investment fund. Then you can add P1,000 every month. Because of this, we can reach financial freedom and you have a financial advisor.”

Asked what his investment portfolio looks like, he said he has investments in (Sun Life) asset management, Sun Life insurance, real estate in Cebu among others.

The earlier one invests, the better, Guidicelli said.

The young actor last year also led a SLAMCI campaign against investment scams that also pervaded the entertainment industry.

In a video ad campaign, Guidicelli offered some tips against get-rich-quickly schemes. Among these are: Check if the entity is registered with the Securities and Exchange Commission (SEC); do some research with the SEC, invest in a company with a brick-and-mortar office; check the entity’s past performance and track record and if it is trustworthy and honest in its dealings.

Aside from the Prosperity Card, SLAMCI will introduce more new offerings this year. Two new dollar-denominated funds will be introduced while a regular investment program will also be initiated in partner banks.