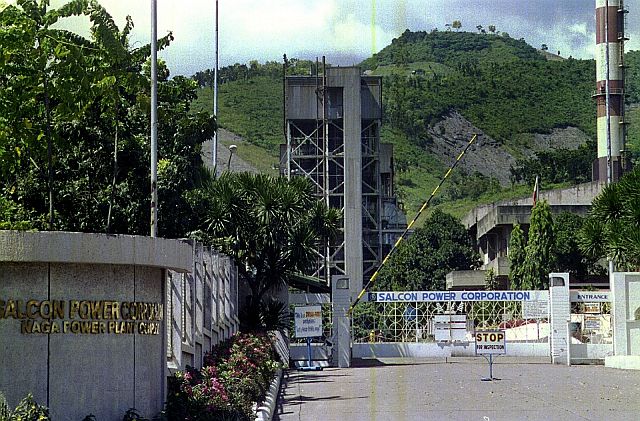

Who gets to operate the Naga power complex? The Supreme Court has upheld its decision that nullified the sale of the facility to SPC Power Corp. (CDN FILE PHOTO)

The Supreme Court (SC) has denied with finality the urgent motion filed by SPC Power Corp. (SPC) to reverse the High Tribunal’s ruling that awarded the Naga Power Plant Complex in Cebu to an Aboitiz subsidiary.

Aboitiz Power Corp., in a disclosure to the Philippine Stock Exchange on Wednesday, said the SC issued its notice of judgment last Nov. 28 denying with finality SPC’s urgent motion.

Last Oct. 26, SPC filed an urgent motion for reconsideration before the SC after the High Court decided to reinstate the awarding of the government-owned 153.1-megawatt Naga Power Plant Complex to Therma Power Visayas Incorporate (TPVI), a subsidiary of Aboitiz Power.

In an earlier statement, SPC said the ruling on the power plant complex was “grossly disadvantageous to the government.”

In its last motion, SPC reiterated its position that the decision “destabilizes the investment climate in the Philippines and retroactively changes the rules on competitive bidding.”

“With the Supreme Court’s ruling to reinstate the notice of award to Therma Power Visayas Inc. (TPVI), the government not only stand(s) to lose P54 million but is deprived of a rebid of the Naga Power plant which would likely result in an even higher price for the government,” SPC said in an earlier statement.

The move followed the previous ruling of the High Tribunal which declared as null and void SPC’s right to top the bid of TPVI by five percent.

SPC Power said the High Court’s decision to reinstate the award of the Naga facility to TPVI was contrary to its earlier position that “public bidding is the better means to secure the best bid for the government.”

It pointed out that the SC, in a decision dated Sept. 28, 2015, stated that “attracting as many bidders to participate in bidding for public assets is still the better means to secure the best bid for the government and achieve the objective under EPIRA (Electric Power Industry Reform Act) to privatize NPC (National Power Corporation) assets in the most optimal manner.”

Power Sector Assets and Liabilities Management (PSALM) held the first bidding for the Naga Power Plant in 2013. But the first two rounds were declared failed bids as only one bidder, SPC, showed up. TPVI joined the third round and won with a bid of P1.089 billion, higher than SPC’s bid of only P859 million.

SPC topped the bid and paid an additional P54 million or a total of P1.143 billion to PSALM. Eventually, the Naga facility was awarded and turned over to SPC in September 2014 despite pending questions regarding the company’s right to top.

In July that year, then senator Sergio Osmena III filed a case with the Supreme Court against SPC and TPVI questioning the validity of the right to top, arguing that it was allegedly noncompetitive.

In its Notice of Judgment dated Oct. 5 this year, the High Court upheld the validity of the public bidding held by the PSALM of the Naga Power Plant but invalidated the condition in the bidding that granted SPC the right to top the bid.

The SC ordered the reinstatement of the Notice of Award issued by PSALM dated April 30, 2014 that awarded the 153.1-mw Naga Power Plant in Cebu to TPVI.

The SC annulled and set aside the Asset Purchase Agreement (NPPC–APA) and the Land Lease Agreement executed (NPPC–LLA) between SPC and PSALM and directed PSALM to execute the NPPC-APA and the NPPC-LLA in favor of TPVI.

Sebastian Lacson, Aboitiz Power coal group president, earlier said that the SC ruling to reinstate the asset to TPVI reinforces the company’s stand that it went through a fair bidding process.

“We believe that our subsidiary TPVI won the bid in a fair and transparent manner. Had TPVI not participated, the government would have sold its asset at a much lower price,” he said.