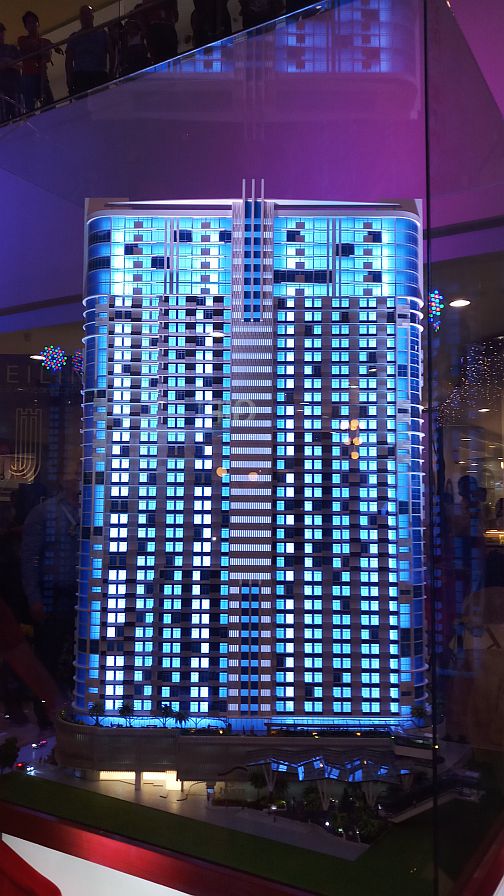

This is the scale model of the 40-storey tower, the first condominium tower for Jiprop Development Corp., the housing arm of Everjust Realty Corp., which is the JCentre Mall developer. The project will add more condominium units in Cebu. / CDN PHOTO Victor Silva

If the number of license to sell (LTS) applications received by the Housing and Land Use Regulatory Board in Central Visayas (HLURB-CRV) in 2017 is any indication, the region’s property sector looks to have been vibrant this year and will continue to be in 2018.

The HLURB-CRV received more LTS applications this year compared to 2016 amid a growing demand for real estate in the region, particularly for economic residential housing units.

“We are positive this trend will continue onward to 2018. We are seeing an increase in the number of applications for LTS every year,” Engineer Francis Ordineza, HLURB-CRV director, said in an interview.

As of Dec. 5, 2017, the HLURB has recorded 162 LTS applications, up by 78.02 percent from 91 posted for the whole year 2016.

The LTS is a certification obtained by a property developer from the HLURB as mandated in Section 5 of the Presidential Decree No. 957, serving as proof that the developer runs a legitimate business and is financially capable to finish the project they are selling.

Among the applications lodged before the HLURB-CRV, 113 were for condominium projects, 48 were for subdivision developments, and two memorial parks.

Out of the 162 applications, however, the agency has only so far approved 60; and 38 of which are subdivision projects, 20 condominiums, and the two memorial parks.

The 60 projects were valued at P23.9 billion, only slightly higher than the P23.8 billion recorded in 2016.

This year saw a drop in approvals from 108 in 2016, of which 62 were for subdivisions, 45 for condominiums, and one for a memorial park.

Ordineza explained that many LTS applications for subdivision projects are still pending because of delays in the approval of survey returns from the Land Management Bureau, an attached agency of the Department of Environment and Natural Resources (DENR).

For condominiums, on the other hand, he said many developers have not yet secured building permits from the local government units of the town or city they are constructing in.

Among the applications for condominium projects this year, 10 were for economic housing, nine were medium cost or open market, while one was for the socialized segment.

Socialized housing units are priced below P450,000, economic units are between P450,000 and P1.7 million, while open market housing costs more than P1.7 million.

Engineer Josefa Ylanan, head of the Cebu City government’s Office of the Building Official (OBO), said most condominium developers, especially those serving the low-cost market, have a hard time complying with the city’s parking space requirements.

“For low-cost condominiums, the developer is required to have one parking slot for every one residential housing unit,” she explained.

She said she believes these developers have the capacity to comply, except they are also trying to maximize their profits.

“We keep reminding these developers to put into consideration in their design the presence of open spaces in their projects. They also need to be aware of the specific laws within the town or city they will choose to locate,” she said.

While the HLURB-CRV has jurisdiction over Central and Easter Visayas, Ordineza said most of applications they receive are for projects located in Metro Cebu, particularly in the highly urbanized cities of Cebu, Mandaue and Lapu-Lapu.

Moving forward, he said they see more developers catering to the socialized and economic housing markets because the demand is there.

According to the Housing and Urban Development Coordinating Council, the country’s housing backlog stands at 5.5 million, of which 1.9 million is in the Visayas alone and is concentrated in the low-cost segments.

However, he said they also expect growth in the take-up for medium to high-cost housing projects in the coming years.

Property management and research firm Colliers International Philippines had said they see a demand for condominium units rising given that Cebu remains as a major hub outside of Metro Manila.

Colliers observed that owning a condominium in Cebu City, particularly, is becoming more popular due to several factors such as the sustained inflow of OFW remittances fueling end-user demand and Cebu being a significant contributor to the total number of Filipino workers deployed from Central Visayas.

Given the growing demand for condominium projects in Metro Cebu, Colliers said they expect over 14,000 units to be completed within this year and 2020, which will further expand options for Cebuano end-users and investors.