Something big is happening in the global supply chain, and if the Philippines plays its cards right, significant manufacturing investments may come its way in the wake of COVID-19.

China has long been the world’s manufacturer, but the novel coronavirus pandemic afflicting the globe has exposed the problem of the world economy depending too much on a single country for many of its products. With China becoming the first epicenter of the COVID-19 crisis, many foreign companies had to take a hit when their factories were forced to stop production as the country moved to contain the spread of the disease.

The health crisis also added to the complications caused by China’s trade dispute with the United States. Foreign firms had earlier shouldered increased production cost for their output coming from the mainland after the Trump administration slapped higher tariffs on thousands of imports from China.

As a result, many American, European, and even Japanese and Korean companies are reportedly now planning—or have decided—to relocate their production bases out of China. These range from automotive and parts manufacturers to IT companies and pharmaceutical and health care services firms.

The Japanese and US governments have involved themselves directly in the effort by offering incentives to companies to bring their investments in China back home to their respective countries. Japan, for instance, already has a $2.2-billion stimulus package to cover the cost for Japanese firms leaving China and returning to Japan.

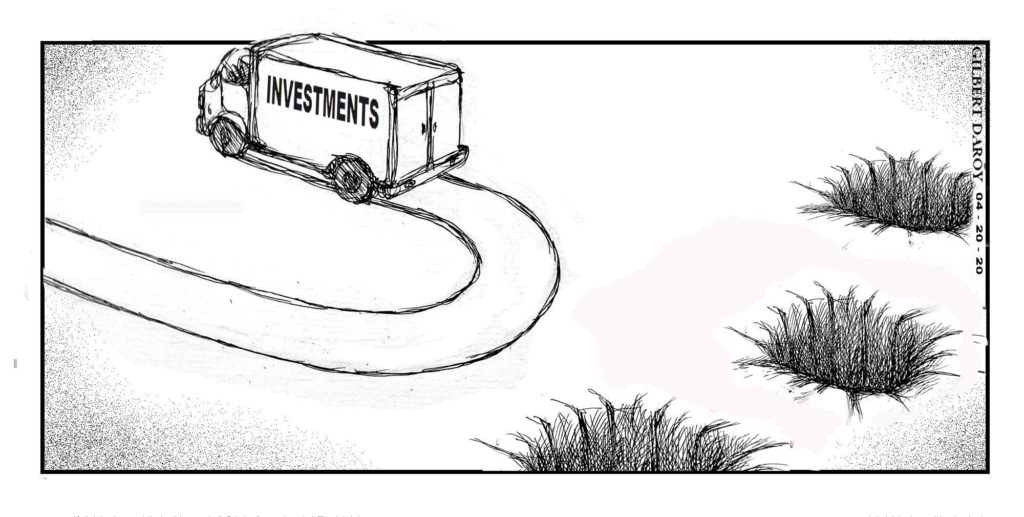

The opportunity for the Philippines, however, is in the thousands of other companies planning to move out of China but not back to their home countries where production costs remain high.

Of course, the Philippines is just one of the possible recipients of these investment dollars leaving China. In fact, some analysts are not even including the country in their list of potential beneficiaries of the shifting investment landscape, pointing to Vietnam as the most likely pick.

According to Forbes magazine, “This ongoing diversification of the global supply chain creates ample opportunities for corporate investors and gives rise to new markets in countries like Vietnam, now getting the equivalent of a steroid shot to beef up their own economy.”

But the Philippines, battered as well by the COVID-19 pandemic, should fight for its share in this development by quickly undertaking what needs to be done to make it more conducive for investors to set up shop here. Pending in Congress are bills to open up more economic sectors to non-Filipinos (although a contentious proposal facing prolonged debate), a reduction in corporate income tax, and a review of the incentives currently available to foreign investors.

Already in place is the Ease of Doing Business Act signed into law in mid-2018, which hopes to further address bureaucratic red tape by improving the efficiency and transparency of government procedures at all levels, down to the local government bureaucracy. Also in place is the Revised Corporation Code of the Philippines, which amended the 40-year-old Corporation Code to create a more business-friendly environment and improve the ease of doing business here. Such easing of the process for starting a business in the Philippines can be a major factor in attracting companies moving out of China.

The 11th Foreign Investment Negative List, signed in late 2018, also further liberalized foreign participation and opened more sectors to foreign investment, allowing 100-percent foreign ownership in internet businesses, training centers that are engaged in short-term high-level skills development, wellness centers, adjustment/lending/financing companies, and investment houses.

The proposed second tax reform package intends to gradually lower the corporate income tax rate, which remains one of the highest in the Association of Southeast Asian Nations. However, being tackled with this measure is the so-called “rationalization” of the various tax incentives given to foreign investors, a planned overhaul that is causing anxiety among some businesses. The sooner Congress hammers out the details of this reform measure, the better for the country’s business environment.

While the focus has understandably been on reopening the domestic economy given the tremendous repercussions of the lockdown, there is an urgent opportunity to be seized now that international businesses are looking for other places to relocate. The Duterte administration has a small window to act and make the country attractive enough for manufacturers getting out of China, especially since the Philippines’ foreign direct investments record has been a laggard compared to its neighbors. Here is a watershed chance for the government to make it right.