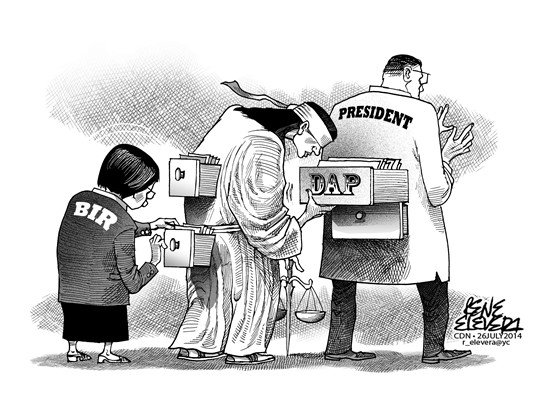

The Supreme Court’s rejection of the Bureau of Internal Revenue (BIR) request for its justices to file their Statement of Assets, Liabilities and Net Worth (SALN) is yet another source of resentment that’s building up within the judiciary as they find themselves in a dispute with the Aquino administration over its handling of the Disbursement Acceleration Program (DAP).

The BIR request was ruled as lacking in sufficient basis by the High Court.

However, they hinted of their real sentiments when they said the request was an act of harassment by the executive, coming as it did after the tribunal ruled that the DAP was mostly illegal.

That wasn’t the case, BIR Commissioner Kim Henares said, since the request came before the DAP controversy emerged and was actually an offshoot of the impeachment of former Supreme Court chief justice Renato Corona.

Aside from taxes on their benefits and allowances, the Aquino-controlled Congress had also threatened to investigate the Judiciary Development Fund (JDF), the Supreme Court’s own pork barrel, to see if abuses were also committed by the men and women on the bench.

One can hardly blame the judiciary and rank and file court employees who wore black shirts and armbands on “Black Monday”. They feel under siege by the Aquino administration.

Which is far from the truth, painful as it is especially for the rank and file who rely on their basic pay, allowances and benefits for a measure of comfort and assistance in making ends meet.

But seeing that all government employees and officials are required to disclose their SALNs every year, the BIR’s move to tax their benefits and allowances should not only be implemented on them but must be extended especially to employees and officials of government-owned and controlled corporations (GOCCs).

Weren’t the GOCCs the first mentioned by then newly elected President Benigno Aquino III in his first State of the Nation address as the ones reaping huge allowances, bonuses and cash incentives?

Like everyone else, judges and their employees from the Supreme Court down to the lower courts should pay their fair share of taxes to the government’s treasury and report their income as required of them under the Constitution.

Everyone, including those at the BIR, should pay his due share of taxes.

At the same time, we trust that the BIR doesn’t overstep its bounds in its collection efforts and ensures that the taxes collected from employees, officials, business enterprises and other private citizens go straight to the government coffers and not to their pockets.