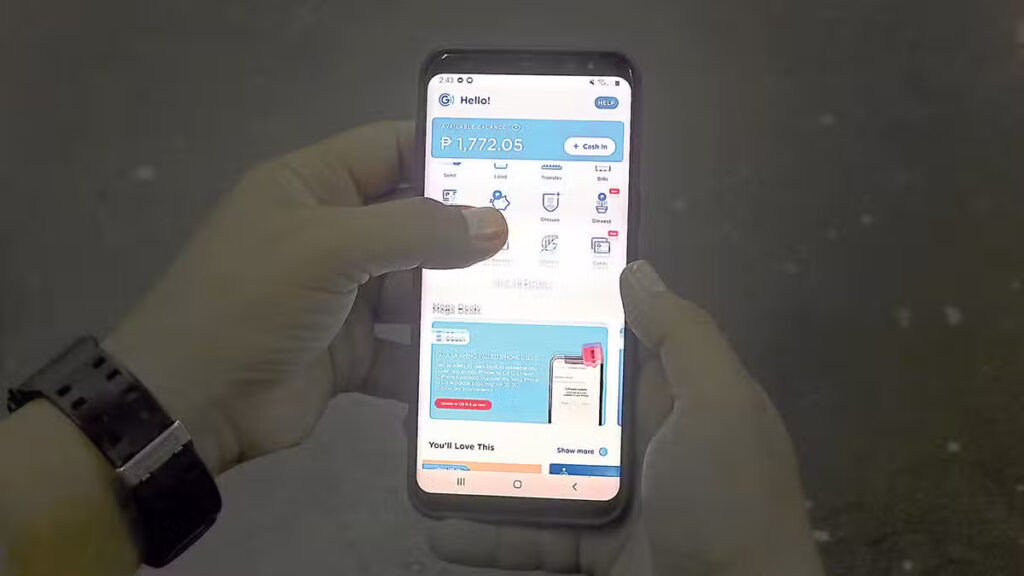

Just days after users reported unauthorized deductions from their accounts, popular e-wallet platform GCash faced another issue.

On Friday afternoon, the Ayala-backed company announced that its bank transfer feature via BancNet was experiencing problems, though the cause was unclear.

BancNet is the Philippine interbank network connecting the automated teller machine networks of 124 local and offshore institutions and serves as the country’s sole national ATM network.

Company statement

In an advisory also issued on Friday, GCash issued another advisory reading:

“Bank transfer to GCash will be right back! BancNet is working to restore the service as soon as possible.

“If your bank account was debited, kindly expect your money to be credited to your GCash wallet within 24 to 48 hours.”

“We are working with our partners to restore the service as soon as possible,” GCash told customers in an advisory.

“All affected transactions will be credited back to your GCash wallet within 24-48 hours,” it added.

‘Internal glitch’

The announcement was made after GCash earlier this month confirmed a separate incident where an “internal glitch” was said to have caused unauthorized deductions in the balances of its users.

GCash clarified that it was not due to hackers, as some had speculated, but there has been no explanation why only GCash has been affected by the unexplained “internal glitch.”

READ: Internal glitch, not hackers, behind GCash unauthorized deductions

GCash says bank transfer glitch now resolved

Thus far, there have been no reports of any lawsuits arising from the glitch.

The Bangko Sentral ng Pilipinas, which regulates the fintech app, said it would complete its probe by mid-December.