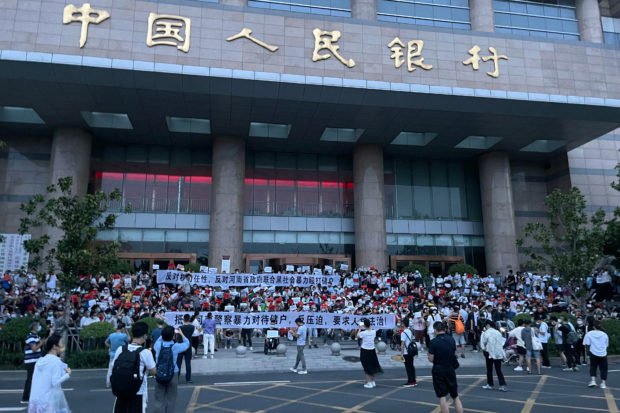

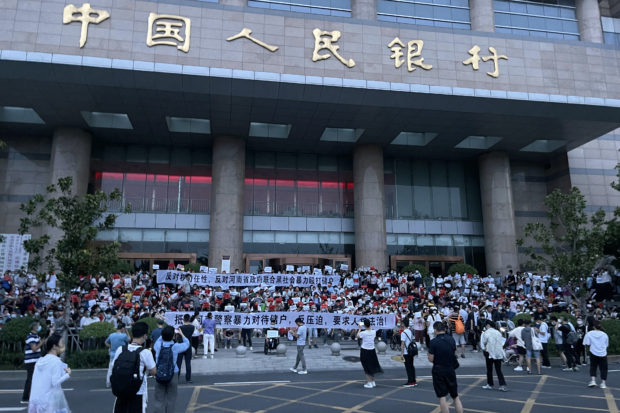

This handout photo taken on July 10, 2022 and released by an anonymous source shows people protesting in front of a branch of the People’s Bank of China in the central Chinese city of Zhengzhou. – Hundreds marched on July 10 in protest against alleged corruption by local officials in the central Chinese city of Zhengzhou, multiple participants told AFP, in a rare public demonstration in the tightly-controlled country. (Photo by Handout / Courtesy Of An Anonymous Source / AFP)

Chinese regulators have promised to repay more victims of one of the country’s biggest-ever banking scandals, after hundreds of thousands of customers were left without access to funds, triggering rare mass protests.

Four banks in Henan province froze cash withdrawals in mid-April as regulators scrutinized alleged mismanagement, leaving billions of yuan in savings locked up and sparking sporadic demonstrations.

Authorities later named those firms and another rural bank in nearby Anhui province as involved in a scheme to defraud investors — and promised victims would start to get their money back.

“Henan New Fortune Group manipulated five village banks in Henan and Anhui to illegally absorb and occupy public funds … and covered up illegal activities,” an unnamed China Banking and Insurance Regulatory Commission representative told state media Sunday, citing a three-month initial police investigation.

“The next stage will be to begin advance payment work for customers with over 50,000 yuan (deposited).”

The Henan banking scandal has dealt an unprecedented blow to public confidence in China’s financial system owing to the size and scale of the fraud, analysts say, with the banks involved allegedly operating illegally for more than a decade,

Chinese authorities are desperate to avoid disruptions to social stability just months away from a major congress of the ruling Communist Party.

A July 10 mass demonstration in Henan’s provincial capital Zhengzhou was violently quashed, with demonstrators forced onto buses by police and beaten, according to eyewitness accounts given to AFP and verified photos on social media.

Shortly afterwards, Henan’s provincial banking regulator said customers with deposits of less than 50,000 yuan ($7,500) would be repaid starting Friday.

But in one WeChat group containing hundreds of depositors, only a handful reported successfully receiving their funds back, according to messages seen by AFP.

A few customers reported receiving their deposits Friday, while others complained that the designated mobile app had bugs and would not let them register, according to local media.

The funds being repaid came from some of the seized assets of Henan New Fortune Group, the company accused by police of manipulating the banks, state broadcaster CCTV reported last week.

Regulators have said depositors will be paid in batches, but did not announce a specific timeframe for the repayment of accounts with more than 50,000 yuan in funds.

RELATED STORIES

China ‘strongest partner’ in PH recovery – Marcos

China looks to Bongbong Marcos to revive oil exploration talks