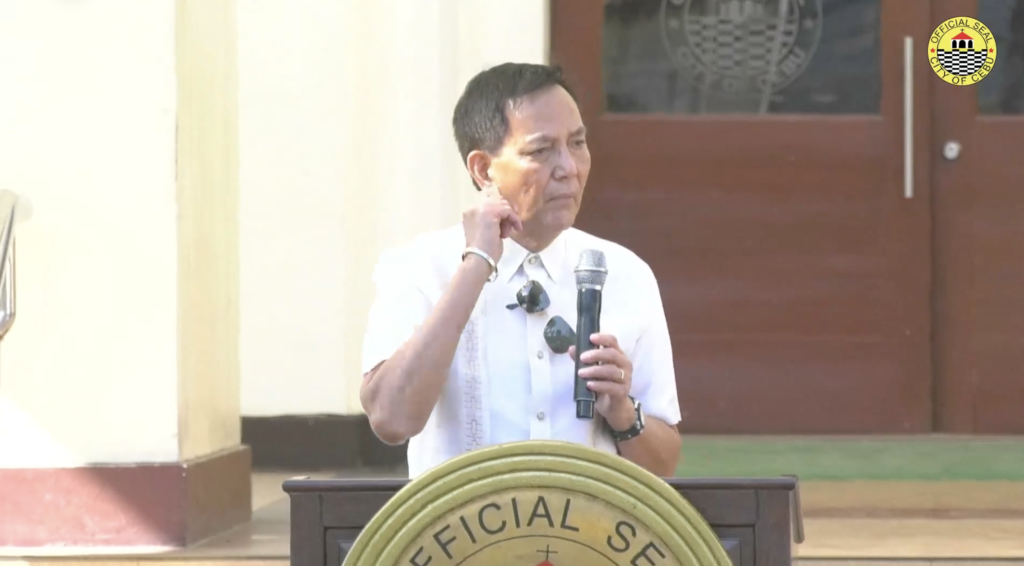

Cebu City Mayor Michael Rama | Photo from Cebu City PIO FB Live

CEBU CITY, Philippines — Cebu City Mayor Michael Rama has reiterated that the proposed revision of the Omnibus Tax Code is in accordance with the law.

He, however, refused to comment on remarks made by some City Council members that the proposed revision, especially of real property taxes, is “excessive” and “oppressive.”

Some councilors also encouraged the continuation of public hearings regarding the matter.

“Atong tiwason (ang public hearings). It is not over yet. The most important thing, in the meantime, (is to) let everybody be heard. I will not be refuting it now. There will be time to refute. I would want democratic process also be institutional,” he told reporters in an interview on Wednesday, November 30, 2022.

“But pretty sure, from the outset, there is a law. Ang uban ganing syudad, continuously updated. Kita? Tungod kay mangahadlok mangapildi, hangtod ang ending nato ang atong valuation, 2006 pa and that is something that we have to confront. Otherwise, maabot na sad tag 2025?” he added.

While he proposed the goal of the current administration in achieving a Singapore-like Cebu City, Councilor Noel Wenceslao, earlier, voiced his and the other councilors’ concerns on the tax rate adjustment which is presently the subject of an ongoing public hearing.

The majority of the council members, according to Wenceslao, the chair of the city council’s budget and finance committee, are concerned about the impact of the proposal to already revise the city’s tax rates, especially its real property taxes.

The council also raised concerns about the progression of the implementation of the tax rate adjustments.

READ: Proposed revised tax rates ‘excessive’ and ‘oppressive’ – Wenceslao

A proposal to revise tax rates is important to the realization of Cebu City’s dream to become Singapore-like, said Atty. Jerone Castillo, the special assistant to the mayor for fiscal matters.

Atty. Castillo, during the previous public hearing, said that the last time the city revised its tax rates was still in 2006. He said the revision is supposed to be done every three years, according to the Local Government Code.

He also recalled an instance in the past wherein the Commission on Audit called the attention of the Cebu City government, through an audit observation memorandum, because of the city’s failure to revise its business and real property tax rates. /rcg

READ MORE:

Tax revisions pushed to fund Cebu City’s P50B budget in 2023