The Securities and Exchange Commission (SEC) ordered Superbreakthrough Enterprises Corp. to stop the solicitation of investments from the public without the proper licensing.

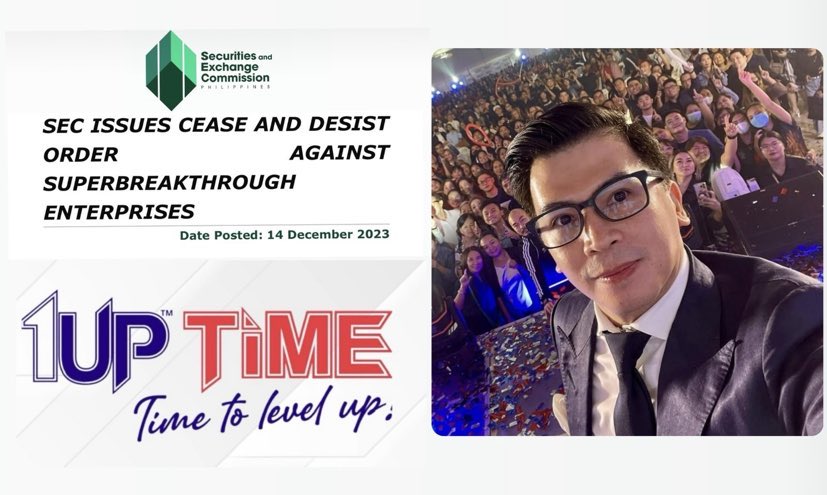

Superbreakthrough Enterprises Corp. is a marketing company operating under the name of “1UP Time.”

The Commission En Banc has directed the company to “immediately cease and desist from further engaging in the unlawful solicitation, offer, and/or sale of securities in the form of investment contracts without the necessary license from the SEC.”

1UP Time offers different investment packages for items like cosmetics, health and wellness, and personal care products.

The items are peddled through social media like Youtube and Facebook.

“The Commission also prohibited the company from transacting any business involving funds in its depository banks, and from transferring, disposing, or conveying any related assets to ensure the preservation of the assets of its investors. The company was likewise ordered to cease its internet presence relating to its investment scheme,” the SEC said in a statement.

“The scheme involves the sale and offer of securities to the public in the form of investment contracts, whereby a person invests his money in a common enterprise and is led to expect profits primarily from the efforts of others.”

The Commission pointed out that solicitation of investments within the Philippines, without an approved registration, is a violation of Section 8 of Republic Act No. 8799, or The Securities Regulation Code.

SEC also clarified that while Superbreakthrough Enterprises is registered as a corporation, it does not have permit to “sell or offer securities to the public”.

“While Superbreakthrough Enterprises is registered with the SEC as a corporation, it has not secured the required secondary license that will authorize it to sell or offer securities to the public, as provided under Section 8 of the SRC, in relation to Section 3 of the 2015 SRC Implementing Rules and Regulations,” said the Commission.

“The Commission En Banc also emphasized that Superbreakthrough Enterprises’ articles of incorporation specifically provides that it has no authority to solicit or accept investments from the public”.

The cease and desist order was issued after the Commission monitored the activities of companies under a certain Juluis Allan Nolasco.

Nolasco reportedly heads Superbreakthrough Enterprises, and other investment companies flagged by SEC.

“Mr. Nolasco has previously been the subject of a cease and desist order for his promotion of illegal investment activities through Alphanetworld Corporation, otherwise known as NWorld,” explained the Commission.

“The order was issued following the continued monitoring activities of the SEC Enforcement and Investor Protection Department over NWorld and Mr. Nolasco, which led to the discovery of the operations of Superbreakthrough Enterprises.”

“The packages, priced from P10,000 to P188,000, promised returns ranging from 25% to 35% worth of product discounts, recruitment bonuses, and other incentives,” it added.

CDN Digital tried to get the side of Nolasco through his Facebook account, but he has not responded as of this posting.

In February 2022, SEC also issued a Cease and Desist Order against Nolasco’s investment firm Alphanetworld Corp.

RELATED STORIES

SEC-Cebu warns public against investment scams

SEC expands online payment options for clients

SEC revokes permit of Julius Allan Nolasco’s Superbreakthrough Enterprises