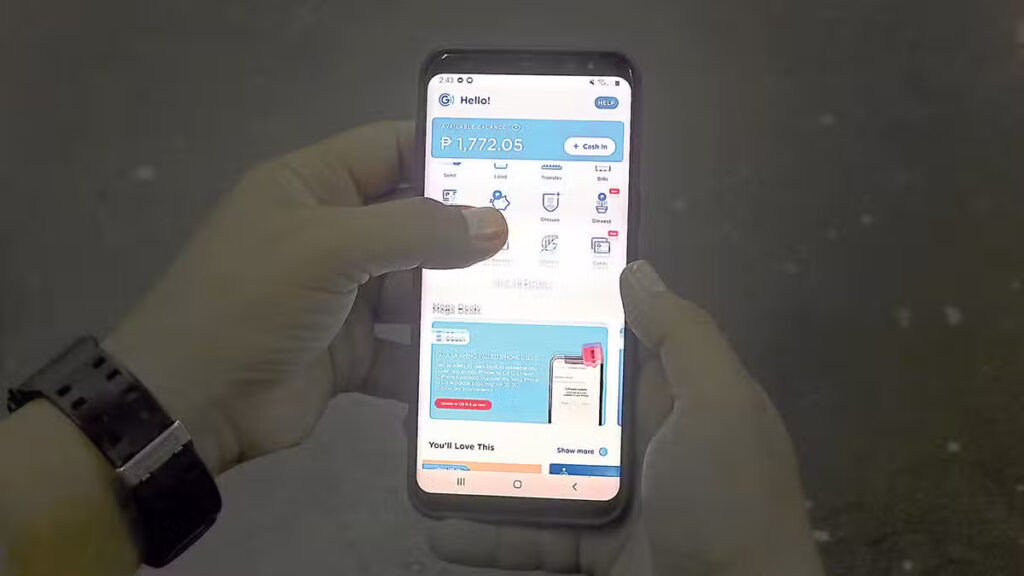

Ayala to sell half of GCash stake to Mitsubishi for P18.4 billion

Ayala Corp. is selling half of its stake in popular e-wallet GCash to Japan’s Mitsubishi Corp. for at least P18.4 billion.

As a result, Mitsubishi will own 50 percent of AC Ventures Holdings Corp ., which in turn owns 13 percent of Mynt, the fintech unicorn behind GCash.

Mynt currently owns GCash operator G-Xchange Inc. and microlender Fuse Lending.

“We believe Mitsubishi can add meaningful value to Mynt, which will allow Mynt to deliver significant value to its over 94 million registered users,” Ayala President and CEO Cezar Consing said in a statement.

READ: GCash now prefers PSE to Wall Street debut

Ayala first announced plans in August to engage a “strategic investor” that would further boost the success of GCash, which gained much popularity during the pandemic lockdown.

In the same month, the country’s oldest conglomerate injected P22.4 billion in Mynt to increase its shareholding in the Globe Group’s fintech arm.

MUFG Bank Ltd., Japan’s largest bank, likewise infused $393 million into Mynt, representing an eight-percent stake.

Overall, these two fundraising activities valued GCash, which has yet to make its stock market debut, at $5 billion.

Disclaimer: The comments uploaded on this site do not necessarily represent or reflect the views of management and owner of Cebudailynews. We reserve the right to exclude comments that we deem to be inconsistent with our editorial standards.