POST PRANDIUM: It is good to raise the SSS member’s contribution

FERNANDO FAJARDO

Beginning next week when April comes, SSS member’s contributions will increase by one percentage point to 12 percent of the credited salary, 8 percent to come from employers, and 4 percent from the employee. The maximum credited salary is also raised to P20,000. The same rates apply to self-employed or voluntary SSS member.

Thus, if your income is exactly P20,000, your employer will contribute P1,600 or 8 percent of the P20,000 to the SSS for you. Your contribution is only P800 or 4 percent of your income. This comes to P2,400 in total monthly contribution credited to you.

With the maximum credited income set at P20,000, even if your income is much higher, your SSS contribution will no longer increase beyond the total amount of 2,400.

By law, the SSS is allowed to increase the member’s contribution rate by one percentage point every other year starting 2019 until it reached 15 percent by 2025.

Is the increase in SSS contribution good?

For the workers, higher SSS contribution today means more cash that you can borrow in future emergencies and higher pensions after retirement. In this sense, it is good.

For the nation as whole, our national savings consist of our households or private savings and government or public savings. Private savings is what is left of our total income (Y) after taxes (T) and after deducting our total household final consumption expenditures (C). Your SSS contribution is part of this.

Public Savings is what is left of total government taxes (T) after deducting total government final consumption expenditures (G).

In short, our total national savings or S = (Y – T – C) + ((T – G).

How big is our total household savings?

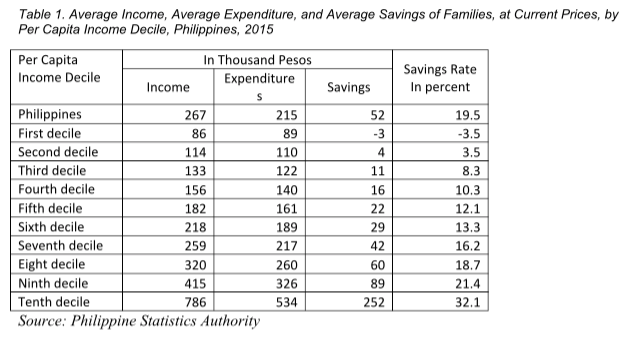

Government data in 2015 shows that the first decile or bottom ten percent or of our total number of households had negative savings rate equal to 3.5 percent of their average household income. The second decile save 3.5 percent of their income, the third, 8.3 percent, and rising with the upper income group reaching up to 18.7 percent savings rate eight decile, 21.4 percent or the ninth decile and 32.1 percent of top most decile.

Overall, we saved only 19.5 percent of our total average annual household income. See the accompanying table below.

On the part of the public savings, the national government was always in deficit in most if not for all the years since the last war up to now.

Nationally, we need more savings for investment to increase our productive capacity as a nation. The more we invest, the more we can increase our national output and raise our national income.

Our present level of development measured in terms of per capita income is still much lower than many our close neighbors in Asia. To catch up, we have to invest more. However, we cannot do so because of our low savings rate. To catch up with our neighbors, therefore, we use the surplus capital from other nations that comes to us in form of foreign loans, grants, or direct investments.

Problems will come if the loans we made were spent on projects that are wrongly identified (not the real need) and/or poorly constructed and managed that do not contribute much to our economic growth.

When this happens, borrowing more from abroad becomes unsustainable, leading to the country’s bankruptcy with more tragic consequences, like giving up part of the national patrimony to the lenders to pay for our loans as supposedly demanded by China for their loans.

Disclaimer: The comments uploaded on this site do not necessarily represent or reflect the views of management and owner of Cebudailynews. We reserve the right to exclude comments that we deem to be inconsistent with our editorial standards.