CEBU CITY, Philippines — A Singapore-based loan provider is opening its doors to entrepreneurs in Cebu who want to get a kickstart in their recovery plans.

Right Choice Finance Corporation (RCF), in a virtual press conference on Wednesday, October 14, 2020, announced that it had officially expanded its operations in Cebu.

Contributed Photo

“We don’t want to delay our launch in Cebu… We’ve come here to extend our assistance to Micro, Small and Medium Entrepreneurs to get back on their feet,” said James Kodrowski, RCF founder and managing director.

James Kodrowski, founder and managing director of Right Choice Financials | Contributed Photo

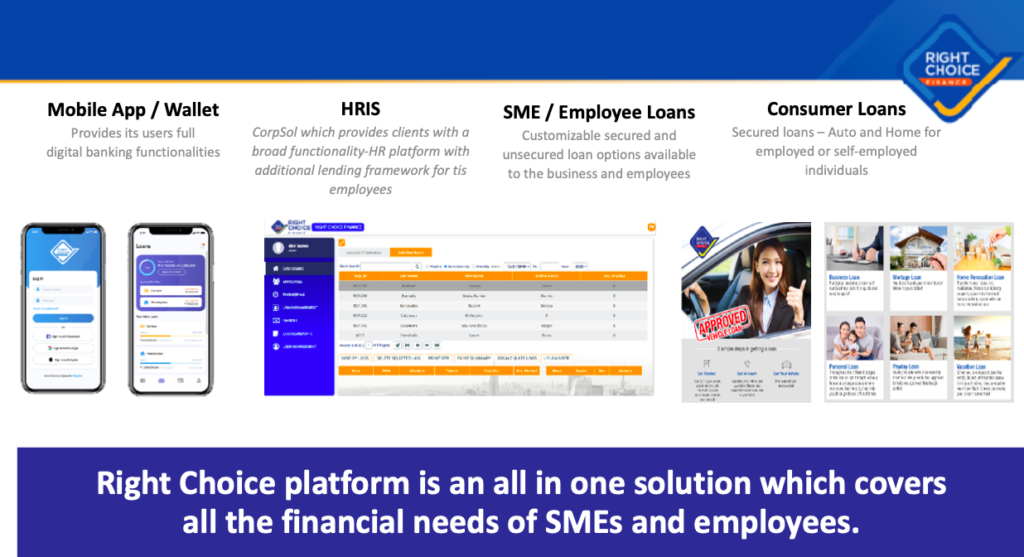

RCF is a wholly-owned subsidiary of Right Choice Capital Pte Ltd headquartered in Singapore, and provides Micro, Small, and Medium Enterprises (MSME) and consumer loans through its digital business platform that combines flexible financing products and innovative human resources software.

To help Cebu businesses bounce back, we will be here to provide that vital support across all stages of MSME development

James Kodrowski

RCF Founder and Managing Director

Headquartered in Makati City, it has been operating since 2016. RCF’s office in Cebu, located in Cebu Business Park, Cebu City, is its first branch outside Metro Manila.

Kodrowski said they chose to expand in Cebu due to its vibrant economic and commercial activities, and that the island-province had been poised to have a strong and quick recovery from the crisis brought about by the coronavirus disease 2019 (COVID-19) pandemic.

Right Choice Financials’ services | Con atritn ed photo

“All signs point to a strong recovery of the economy. In the Philippines, we were having a good run. Businesses were thriving, the economy is doing well. The government has provided great support, and right now, everything is manageable,” Kodrowski said.

“RCF is a B2B company. To help Cebu businesses bounce back, we will be here to provide that vital support across all stages of MSME development,” he added.

Digital

With its digital banking functionality, RCF clients can receive their funds within 24 to 48 hours after submission, evaluation, and approval. Funds disbursement is through the RCF e-wallet that allows users to conveniently manage their funds, pay their bills, and transfer money online.

RCF’s digital platform and e-wallet services also enable them to provide unique investment options and competitive returns to clients.

Business loans are available to entrepreneurs to keep them going and growing during this difficult time. Meanwhile, consumers can apply for personal loans to fund their needs for housing, vehicle, education, and other endeavors.

To know more about RCF, visit their website rightchoicefinance.ph or email them at info@rcf.ph.

/dbs