Investors optimistic on strong recovery for earnings, stocks

MANILA, Philippines — After a nerve-wracking year marked by an unprecedented lockdown to contain a coronavirus (COVID-19) pandemic, investors are looking forward to a recovery in corporate earnings and stock prices this 2021.

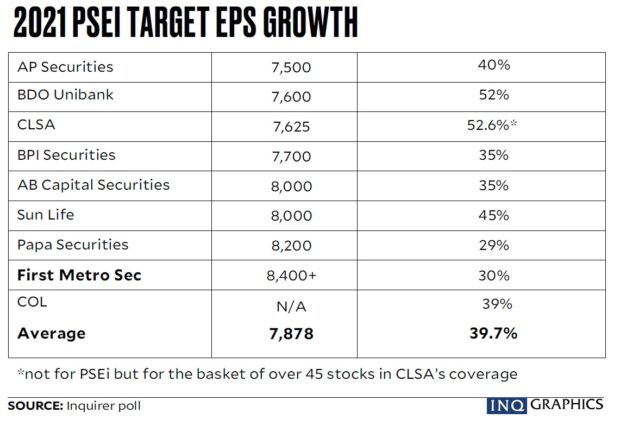

The main-share Philippine Stock Exchange index (PSEi) may rebound to 7,878 this year on the back of a 39.7 percent recovery in earnings from last year’s level.

The yearend PSEi outlook – a median of forecasts by AP Securities, BDO Unibank, CLSA, BPI Securities, AB Capital Securities, Sun Life of Canada, Papa Securities and First Metro Securities—suggests an average upside of 738.41 points or 10.3 percent from last year’s finish.

In 2020, the PSEi declined by 8.6 percent to close at 7,139.71. The index hit a low of 4,623.42 on March 19 when the whole of Luzon was placed under enhanced community quarantine before other key regions followed suit. As of year’s end, however, the index has clawed back 2,516.29 or 54.4 percent from the year’s bottom as investors welcomed the easing of lockdown restrictions and positive news about COVID-19 vaccine development and distribution.

Full year 2020 consensus forecasts suggest an average decline in earnings per share (EPS) of about 47 percent. This as the domestic economy fell into its deepest recession in recent history—the first contraction since 1998. Gross domestic product (GDP) last year was expected to have declined by 10 percent.

Last year, foreign funds were net sellers to the tune of P128.65 billion, compared to P14.26 billion in foreign outflows seen in 2019. Daily average value turnover slightly improved to P7.35 billion from the P7.29 billion in 2019.

Strong recovery

For 2021, an Inquirer poll showed 2021 PSEi forecasts ranging from a low of 7,500 to a high of 8,400, while EPS growth forecasts ranged from 29 to 52 percent.

Jonathan Ravelas, chief strategist at BDO Unibank, said the bank’s PSEi target of 7,600 this new year assumed a 52-percent EPS growth. This also considers that investors will be willing to pay 18 times the projected earnings this year versus the 15-year price-to-earnings ratio of 17 times the projected earnings.

Ravelas said he expected the conglomerates and property sectors to lead the stock market recovery. However, he noted that risks to this benign outlook would be uneven recovery and weakening economic indicators.

This year, BDO expects Philippine GDP to grow by 6.9 percent, driven by government infrastructure spending.

Rachelle Cruz, head analyst at local stockbrokerage AP Securities, which has a base-case index target of 7,500 this year, said: “Any further market re-rating hinged on key catalysts, including widespread use of vaccine, return of foreign flows, impact of FIST (Financial Institutions Strategic Transfer) and CREATE (Corporate Recovery and Tax Incentives for Enterprises) bill, and expedited infrastructure spending to support economic recovery.”

“On a sectoral basis, we prefer consumer, holdings and banks. At this point, we remain stock selective and focus on cyclical names that will ride (on the) reopening of the economy,” she added.

AP Securities is expecting EPS growth in 2020 to fall by 32 percent to P308, before recovering by 40 percent to P432 this year.

First Metro Securities expects EPS in 2021 to rebound to P434.17, 30-percent higher than its projected EPS level of P333.98 in 2020.

Unprecedented decline

The year 2020 was truly unprecedented for the stock market with the circuit breaker triggered three times and with the PSEi recording its steepest intra-day drop in PSE history, said PSE president Ramon Monzon.

“The main index may have failed to return to pre-pandemic levels but it’s good to see that it managed to stay above the 7,100 level,” he said.

The All-Shares index also finished lower year-on-year, down by 8.1 percent. Among the sector indices, only mining and oil closed higher, gaining by 17.8 percent. The financials sector, on the other hand, was the most battered last year as its sub-index slid by 22.3 percent year-on-year.

While it is tempting to write off 2020, Monzon said several achievements last year could not be disregarded.

“We had the listing of the first real estate investment trust (REIT) after more than a decade-long wait. Even with the pandemic, we had a decent capital-raising pipeline, including the listing of the biggest IPO (initial public offering) ever in the history of PSE. Our trading system was up 100 percent during the enhanced community quarantine period when we had to close the trading floor,” Monzon said.

Ayala Land-sponsored AREIT raised the curtain on this new asset class last year. REIT is a corporation that primarily invests in income-generating real estate such as office spaces, shopping malls, service apartments and even hotels, hospitals and warehouses. It gives investors an opportunity to invest directly in the finished projects rather than the developer itself. This was meant to attract dividend-seeking investors because the REIT law required the distribution of at least 90 percent of income as dividends annually.

Meanwhile, Monzon also referred to the landmark P29.1-billion stock market debut of fiber internet and digital service provider Converge ICT Solutions Inc.

For more news about the novel coronavirus click here.

What you need to know about Coronavirus.

For more information on COVID-19, call the DOH Hotline: (02) 86517800 local 1149/1150.

The Inquirer Foundation supports our healthcare frontliners and is still accepting cash donations to be deposited at Banco de Oro (BDO) current account #007960018860 or donate through PayMaya using this link .

Disclaimer: The comments uploaded on this site do not necessarily represent or reflect the views of management and owner of Cebudailynews. We reserve the right to exclude comments that we deem to be inconsistent with our editorial standards.