Notices sent to over a hundred suspected tax delinquents in Cebu, Bohol

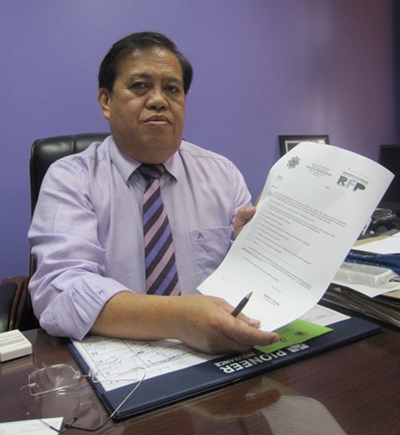

BIR 7 Regional Director Hermeno Palamine shows a copy of the letter sent to over a hundred lawyers in Cebu and Bohol, mandating them to submit all books of accounts and other documents for the bureau to determine if they have paid correct taxes. (CDN PHOTO/ADOR VINCENT S. MAYOL)

“In this world nothing can be said to be certain, except death and taxes.”

Lawyers in Cebu and Bohol will now be facing the certainty of paying their dues to the government after the regional office of the Bureau of Internal Revenue (BIR) has started to go after over a hundred lawyers they identified as tax delinquents.

“Tax compliance rate for Cebu lawyers are really low. Yes, there are those who pay taxes, but the amount they give doesn’t actually reflect what they are supposed to give to the government.

Others, on one hand, do not pay taxes at all,” BIR OIC Regional Director Hermeno Palamine told Cebu Daily News.

Palamine, who is a lawyer, said of the 805 registered self-employed lawyers in Cebu, 52.7 percent or about 417 filed their income tax returns (ITR) while only 2 percent paid their value-added tax.

“Would you believe that there are veteran lawyers here who pay lesser taxes compared to rank and file employees? It’s really sad because paying taxes faithfully should have been a basic duty of every Filipino,” he said.

The local BIR chief declined to reveal the names of those in their target list, but showed a facsimile of a notice they sent out to lawyers in Cebu and Bohol.

The pro-forma notice informed the recipients that the BIR had conducted a pre-audit of their ITR for taxable year 2012 in connection with the Tax Watch Ads Campaign of the Department of Finance and the Bureau of Internal Revenue (BIR).

The notice, signed by Palamine, then directs the recipients to submit the documents indicated in tick boxes to the Assessment Division of the BIR Revenue Region No. 13 in Cebu City.

The suspected tax delinquents were given 15 days to comply.

“We already sent letters to more than a hundred lawyers in Cebu and Bohol. These lawyers were randomly chosen. But we will eventually send the same communication to all lawyers here,” he said.

‘Boss’ Kim knows

Palamine said the BIR is bent on filing tax evasion charges against those who refuse to have their tax records reviewed. Thus far, he added most lawyers who earlier received notices from the BIR have complied with the order. The move, he said, has the blessings of BIR Commissioner Kim Henares.

“This is a friendly approach. Honestly, it is difficult for us to monitor tax compliance of professionals since the BIR lacks manpower. But we are trying our best to achieve our goals,” he explained.

The intensified tax collection was launched after the BIR faltered in their tax collection targets last year. The tax agency came under fire after it launched a series of advertisements revealing the amount of taxes paid by companies grouped by sectors.

An ad comparing the amount of taxes paid by doctors and teachers drew flak from the medical profession. In March this year, the BIR zeroed in on doctors in Cebu and Davao in which they said that 90 percent of registered doctors either did not pay income taxes or paid taxes in amounts smaller that what public schools teachers had remitted in 2012.

The BIR also revealed that in Cebu alone, 1,150 doctors did not declare any income taxes due in the same year.

Revenue Region 13 which covers Cebu and Bohol is among the four BIR regions that performed well nationwide. According to the BIR, the region exceeded its goal by 2.8 percent, collecting 10.8 billion from five revenue districts in Cebu and Bohol in the first half of the year.

Palamine said aside from lawyers, they are also targeting other self-employed professionals like engineers and accountants.

Palamine has also appealed to the Integrated Bar of the Philippines (IBP) to help them ask the members of the legal profession to pay their taxes correctly.

CIVIC duty

IBP Cebu Chapter President Erwin Rommel Heyrosa said he has nothing against the BIR’s move to collect correct taxes from lawyers.

“We’re willing to comply with that order from the BIR. We’re not tax evaders. It’s our duty and obligation to pay taxes regardless of how the government will use them,” he told CDN over the phone.

Although he has not received any letter from the BIR, Heyrosa said he’s willing to request members of the IBP Cebu Chapter to heed the bureau’s call.

Democrito Barcenas, former IBP Cebu City Chapter president, said lawyers should not be adamant to what the BIR has asked them to do.

“It’s our duty to help the government. If I will receive that letter from BIR, I will comply as much as possible. Without taxes, the government will not exist. We need money for the maintenance of the government,” said the 76-year-old Barcenas who has been a lawyer for 53 years.

Lawyer Rameses Victorious Villagonzalo admitted he was among those who received a notice from BIR. “This is the first time I received such notice,” he told CDN over the phone.

To avoid any conflict, Villagonzalo said he decided to submit all the documents the BIR wanted to inspect. He said the BIR recomputed his taxes and disallowed some items like an amount for the purchase of magazines.

“I had already settled with the BIR whatever there is to comply with. I don’t have to wait for the bureau to sue me. I understand the mandate of BIR although I know I have faithfully settled my tax dues every year,” he said.

Chilling effect

Jonathan Capanas, dean of the University of San Jose-Recoletos’ College of Law, said the BIR’s move somehow sends a “chilling effect” to all taxpayers, not just lawyers. “For those with tax deficiences, it’s really a cause for concern for them. So far, I have not received the BIR notice. I think it’s just part of the standard procedure. It’s a question of factual basis of any tax assessment,” he said.

Cordova Mayor Adelino Sitoy, former law dean of the University of Cebu, said lawyers just have to settle their tax dues to avoid brushes with the law.

“When I was practicing, I paid handsome amounts in income tax. As member of the noblest profession in the world, let us cooperate,” he said.

Lawyer Pedro Leslie Salva, the counsel of controversial policeman Adonis Dumpit, said lawyers are not exempted from paying taxes.

“On my part, I paid taxes. That’s our legal obligation as responsible citizens of the nation. I have not received that BIR letter yet. I hope I will not,” said Salva who has been a lawyer for 23 years.

Related Stories:

Taxpayers urged to study BIR’s tax moves

BIR: Pay your taxes now or be sorry

Disclaimer: The comments uploaded on this site do not necessarily represent or reflect the views of management and owner of Cebudailynews. We reserve the right to exclude comments that we deem to be inconsistent with our editorial standards.