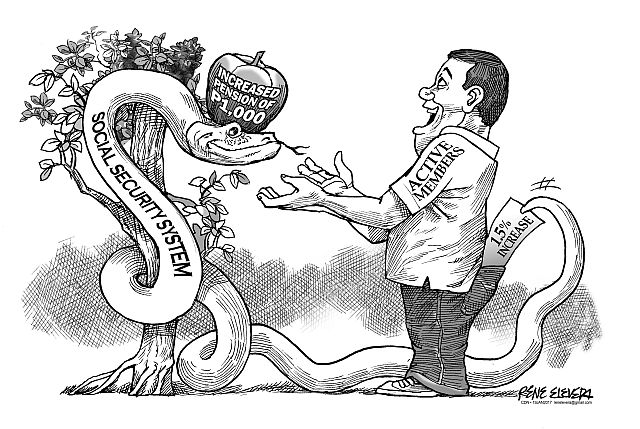

After much deliberation, President Rodrigo Duterte signed the P1,000 increase for Social Security System (SSS) pensioners last Tuesday, but it came with a corresponding 1.5-percent contribution hike from the active members who may or may not reap the benefits of a slightly higher pension if the SSS funds run out more than 20 years from now.

A lot of those who complained about how small the increase was, especially the militants who demanded that the government cover an additional P1,000 for pensioners to make it P2,000, clearly didn’t have an idea how to source out funds to finance it.

In the end it was the members, the private sector employees, who still pay for the premiums who will shoulder the burden of a P1,000 increase to the pensioners who number less than those active workers.

Yet collective sympathy for the plight of the pensioners should at least ease whatever objection the private sector may have against the increase since most of the beneficiaries happen to be the parents of these members.

In their sunset years, the pensioners do deserve to receive something extra if only to help them buy their medicines and even support unemployed and underaged family members.

According to some estimates, each of the members will have to pay an average of P26 more to support the P1,000 increase in pension which in this day and age hardly amounts to anything unless one receives far less than the prescribed minimum wage set by law.

The corresponding increase in fees for members doesn’t guarantee a longer shelf life for the SSS in the sense that it would manage to sustain itself for generations to come.

But an intensified collection effort by the SSS on errant companies as well as plans to collect SSS contributions from overseas employees may do the trick, provided that overseas workers agree to the proposal by the Department of Finance.

Though supportive of the increase, senators allied with the Liberal Party (LP) noted that the Social Security Law or Republic Act 8282 prohibits any increase in benefits issued to pensioners or members that is sourced by raising contributions from members.

But despite Sen. Franklin Drilon’s argument that the increase should be paid for by the fund without any increase in contributions in accordance with the law, it is the active members who eventually sustain the lifespan of the state-run social insurance program.

Unless the government can compel businesses to raise their counterpart contributions of its employees to the SSS or pass a law requiring the overseas workers to also pay premium, the fund’s sustainability remains in serious doubt.

The government, specifically the Duterte administration, has enough time to find ways to resolve this without unduly burdening the Filipino taxpayers.

Disclaimer: The comments uploaded on this site do not necessarily represent or reflect the views of management and owner of Cebudailynews. We reserve the right to exclude comments that we deem to be inconsistent with our editorial standards.