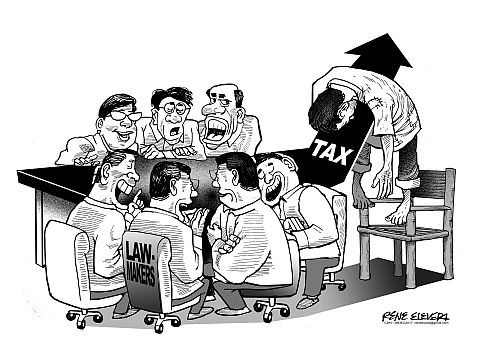

Whatever side of the political spectrum one is, or if he or she is a political in the first place, taxes will always remain a contentious, divisive issue that will, more often than not, cross political boundaries.

In the case of the government’s Tax Reform for Acceleration and Inclusion (Train), it wasn’t all smooth sailing as President Rodrigo Duterte himself admitted that some of his own allies balked at certain provisions they deemed to be anti-poor.

Despite this, the Train did finally get off the ground and was approved by the President before the year ended. Whether or not it will help deliver on the administration’s promise to build massive infrastructure is something to be hoped for despite fears and concerns that it can be exploited by the rich and corrupt.

On the surface, the Train promises to ease the tax burden on the middle income class, which remains the crucial link to developing a country’s economy.

For one, those earning P250,000 and below annually will be exempted from paying income tax, while those earning above it follows brackets that provide for lower income taxation schemes than what is currently imposed on wage earners.

This is what the government’s finance experts had been telling the public days after the President signed Train into law. But critics have pointed out that any boon will be offset by higher taxes on vehicles, fuel and some commodities that are considered luxuries.

One such example is that fuel taxes will likely impact on the consumer as public utility vehicles (PUVs) will have grounds to justify fare rate increases. But if the government experts are to be believed, the collected revenue may go to modernizing public transport, which has yet to be delivered.

Certain items like products with high sugar content and even tobacco will be charged higher on the grounds that it is bad for one’s health, but this will also impact heavily on the livelihood of tobacco farmers.

Trying to assess how Train will impact on the average person’s income and livelihood will take more than a few months of implementation, yet any new tax law will always be up for debate and concern.

The expectation with any new tax law is that it will result in further belt tightening. But that doesn’t mean one has to suffer as a result. With Train being touted as a major overhaul of the country’s tax system to make it simpler and more responsive, it’s up to Filipinos across the country to make their own necessary adjustments, which may or may not compromise their expenditures and budgets.

So far we have managed to survive the Value Added Taxes (VAT) and public clamor remains an effective barometer for our government to gauge and adjust the country’s tax laws to accommodate their constituents and not just the country’s minority elite who should be made responsible to shoulder the bigger tax burden.