Former Finance Secretary De Ocampo favors TRABAHO Bill, sees tax compromise for ecozone firms

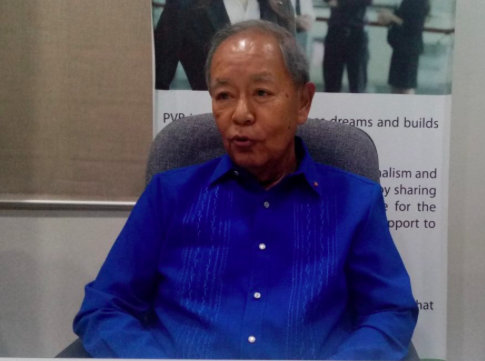

Former finance secretary Roberto De Ocampo says the Philippines has to implement reforms in corporate income tax to compete with neighboring counties. | Irene R. Sino Cruz

CEBU CITY— Former Finance Secretary Roberto De Ocampo favors the Tax Reform for Attracting Better and Higher-quality Opportunities (TRABAHO) bill, the second package under the administration’s comprehensive tax reform program (CTRP).

“The thrust of the administration in terms of combination of reforming the tax system and building the infrastructure is something that I will have a very difficult time objecting to because it is almost exactly the same pattern I followed when I was secretary of finance,” De Ocampo said when asked to comment on the TRABAHO bill.

“In fact, the present tax that they are updating and improving is called CTRP introduced by me during my time,” he said.

He said that the twin pillars – reforming the tax system and building infrastructure – were very similar.

Train Law

“The approach is also quite similar. The Train Law has two general components. One has to do with individual income tax and the other has to do with corporate income tax,” De Ocampo said.

“In both cases, the idea was to simplify the tax bracketing, which was what we did in CTRP, and to lower the rates particularly for the poorer communities, in case of individual people; and in the case of corporate to lower it so that we become competitive with other countries around us because we had the highest tax rates,” he said.

The country’s corporate income tax rate of 30 percent is higher than that of Singapore (17 percent); Vietnam and Thailand (20 percent); Malaysia (24 percent) and Indonesia (25 percent). The TRABAHO bill aims to gradually reduce the corporate income tax to 20 percent.

“Nobody’s complaining about the lowering of the corporate income tax rate. The complaint happened because in order to replace what you will be losing in terms of lower tax rates, you have to reform the incentives,” he pointed out.

According to De Ocampo, people get used to incentives, which were supposed to be given to infant industries, and they get spoiled.

He recalled that he had tried to make changes in the incentives scheme, especially since many incentives had been given to industries that were no longer in the infant stage.

However, he said he encountered opposition from other government agencies.

Investments decline

The Philippine Economic Zone Authority (PEZA) has expressed concern over the possible decline of investments in the ecozones. PEZA reported that PEZA-registered investments fell 41 percent in 2018 while investment pledges reached only P140.24 billion, down 40.97 percent from a year earlier.

De Ocampo noted that companies operating within the economic zones expressed concern over the removal of the preferential five percent gross income earned (GIE) currently offered by PEZA.

The TRABAHO bill proposed that the corporate income tax (CIT) be imposed on the net income, which some theorized could open the door to unscrupulous personnel of the Bureau of Internal Revenue to negotiate the tax that they actually pay, he said.

“Whereas, if it (CIT) is based on gross (income), there would be nothing to negotiate,” De Ocampo said.

“It could be possible that it may end up with some kind of compromise with the CIT imposed on gross but the rate would go up from the present five percent,” he added. /dbs

Disclaimer: The comments uploaded on this site do not necessarily represent or reflect the views of management and owner of Cebudailynews. We reserve the right to exclude comments that we deem to be inconsistent with our editorial standards.