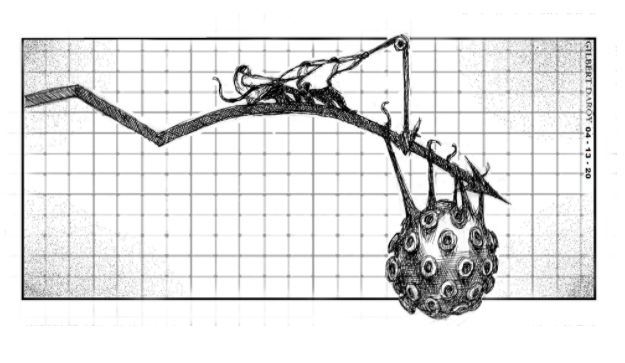

Plunging projections

Stock markets around the world staged strong rallies early last week, giving the impression that the fight against the global coronavirus pandemic was being won. While the rebound faltered by midweek, it showed how investors were hungry for positive developments, their decisions swayed by even the smallest signs of hope in the global war against the health crisis.

The market surges were fueled by news of a slowdown in the spread of COVID-19, particularly in hot spots like Spain and Italy, coupled with a flurry of reports about economic stimulus programs being launched, mainly in the developed countries. Economic stimulus programs are spending boosts by governments to resuscitate economic activity devastated by the pandemic, which has virtually shut down vital industries such as manufacturing, tourism, and air travel.

The realization that the battle against COVID-19 is far from over is very apparent in the Philippines, where projections on the impact of the crisis on the economy have gotten worse by the day. With the two-week extension of the enhanced community quarantine (ECQ) in Luzon to the end of April, the Duterte administration now expects the economy to post zero growth or even contract by 0.8 percent this year. This is a reversal from earlier growth projections of at least 2-4 percent.

The Asian Development Bank also warned of huge losses if the Philippines fails to contain the virus outbreak by midyear, as economic recovery can lag if its engines — the supply chain, businesses and their workforce — are not revived as soon as possible.

Money sent by overseas Filipino workers will also slow, it added, noting that large flows of remittances come from the United States, Europe, and the Middle East, which collectively supply 70 percent of all remittances but which are similarly grappling with the pandemic.

The five large industries most affected by COVID-19 both in terms of output and employment include agriculture, mining and quarrying; business, trade, personal and public services; hotel/restaurants and other personal services; light/heavy manufacturing, utilities and construction; and transport services.

The International Air Transport Association, the trade group of the world’s airlines, noted that the Philippines can see job losses of as many as 419,800 in the air transport and tourism sectors as passenger demand falls 36 percent this year. The figures represent about 21.88 million passengers and revenue losses of $3.5 billion for local carriers Philippine Airlines, Cebu Pacific, and AirAsia Philippines.

The government is still far from truly being able to assess the impact on the economy, although the economic team said it is now crafting a plan to avert the prospect of a slow recovery and massive job losses. According to Finance Secretary Carlos Dominguez III, the government is determining the damage to different economic sectors so it can devise a workable plan for repair and estimate the funds required as well as the avenues to finance such a plan.

As with other countries, Malacañang is looking mostly at boosting infrastructure spending to create jobs, stimulate demand, and provide enhancement of connectivity, with the hope that the private sector will respond to these initiatives by igniting its own investments with speed and enthusiasm and thereby help the country regain economic momentum.

When a plan is drawn up, funding can come from the $5.7 billion (more than P288 billion) in loans from multilateral lenders already in the pipeline, on top of a supplemental 2020 budget to be requested from Congress. The loans will be low-interest credit from multilateral lenders such as the World Bank and the Asian Development Bank.

Globally, much uncertainty remains as to when the COVID-19 crisis will ease significantly, and the extent of harm it will inflict on the world economy. Without clear signs that the pandemic has peaked, it is also unclear how long or deep the projected recession will be. Indeed, the Philippines and the rest of the world remain starving for good news, and the financial markets’ rally last week was a case of short-lived, premature optimism with the world yet to definitively turn the corner in the fight against the pandemic.

Disclaimer: The comments uploaded on this site do not necessarily represent or reflect the views of management and owner of Cebudailynews. We reserve the right to exclude comments that we deem to be inconsistent with our editorial standards.