Cebu PB asks DTI, BIR to be lenient on online sellers amid COVID crisis

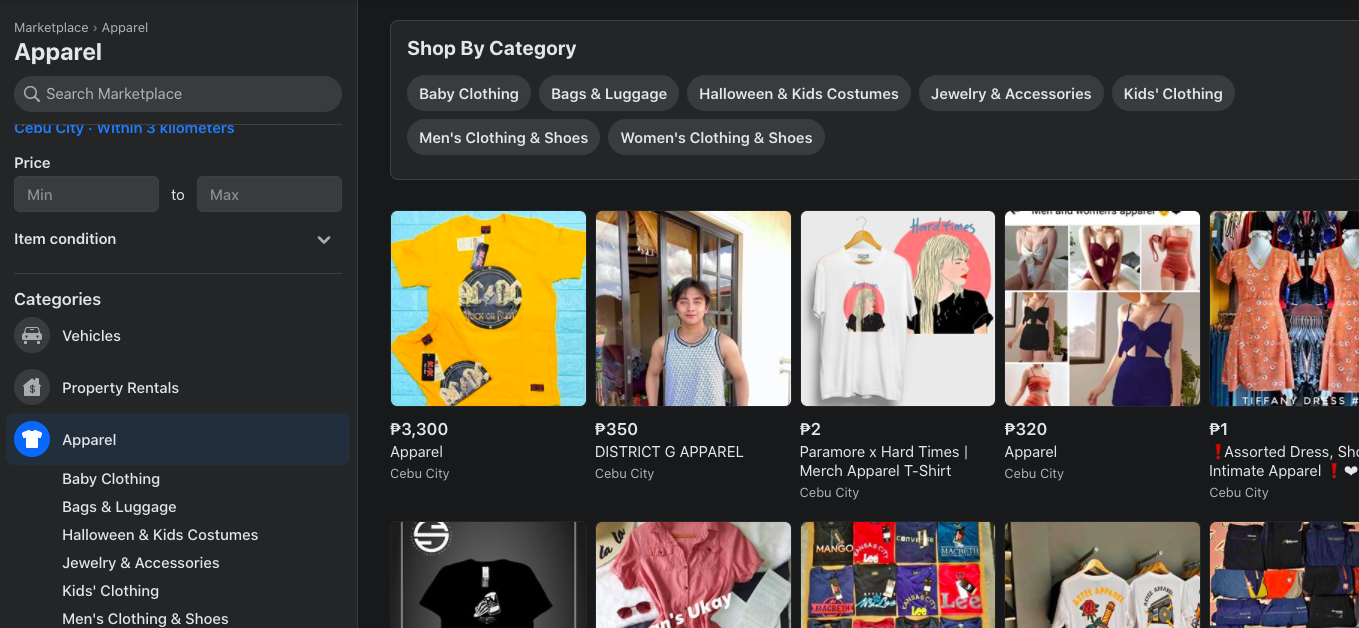

Facebook Marketplace is among venues for online selling which several members of the public resorted to amid the economic struggle brought by the COVID-19 pandemic.

Cebu City, Philippines — Show leniency and liberality in applying laws on small-time online businesses considering present economic struggles due to the coronavirus pandemic.

Cebu Provincial Board made this appeal to the Bureau of Internal Revenue (BIR) and the Department of Trade and Industry (DTI) amid the latter’s recent insistence of regulation and tax collection of those engaging in online trading, including barter group.

Board Member Glenn Anthony Soco, who chairs the Committee on Trade and Industry, in a resolution, pointed out that with the challenges of unemployment and the ongoing quarantine restrictions, the public has been struggling to survive and make ends meet.

“Regardless of these circumstances, household bills and expenses are piling up. The need to get by with day-to-day finances is inevitable,” Soco’s resolution reads

The resolution was adopted by the Sangguniang Panlalawigan during their regular session on Monday, July 27, 2020.

“Everyone is forced to thrive, be creative and innovative in making money. Despite with being at home, the pursuit to make a living, by all possible means, is a decision that each one must make every single day in the face of all strict guidelines on quarantine,” the resolution reads.

In the middle of the quarantine period, individuals resorted to online selling to gain income.

Trading communities, including barter or the traditional exchange of goods, have trended on social media platforms.

In an Inquirer report, DTI Secretary Ramon Lopez recently said that barter trading is only taxable if it is treated as a business.

Read: Lopez: Barter taxable only if treated as business

The Trade and Industry Secretary made the clarification after drawing flak an earlier pronouncement that barter is not allowed, saying that the Department of Trade and Industry (DTI) will go after those involved in online barter.

The BIR, for its part, told online sellers last June to register their business activities and settle their tax obligations not later than July 31.

Read: BIR tells online sellers: Register business activities, settle taxes

“In as much as compliance with the law and the payment of taxes are of equal significance, an appeal is made to the national government to balance these with the impact and possible effect to the community during this pandemic,” the PB said.

Soco’s resolution also pointed out that the present rampancy of online trade must be supported as it facilitates the circulation of money and keeps the economy moving without violating health measures placed against COVID-19.

“Apart from those, it supports the delivery service sector and other informal workers who are few of those displaced due to the pandemic,” it added. /bmjo

Read: CBC to Members: Don’t be afraid to ask a lot of questions to avoid bogus barters

Disclaimer: The comments uploaded on this site do not necessarily represent or reflect the views of management and owner of Cebudailynews. We reserve the right to exclude comments that we deem to be inconsistent with our editorial standards.