How to get your Digital TIN ID

CEBU CITY, Philippines – Starting December 1, Filipinos no longer need to physically queue inside the Bureau of Internal Revenue (BIR) to get their Taxpayer Identification Number or TIN.

The BIR on December 1 announced the launching of the Digital TIN portal that will facilitate the registration and production of the digitized version of the TIN IDs.

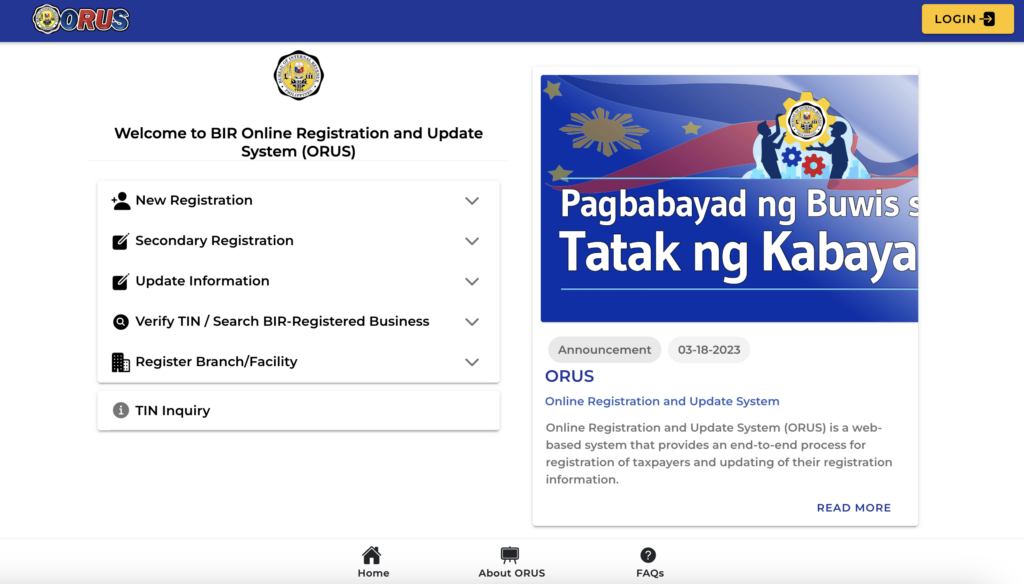

This new feature is part of the bureau’s existing Online Registration and Update System (ORUS).

“Digital TIN ID is now available. No need to line up in RDO (Revenue District Office), said BIR Commissioner Romeo Lumagui Jr. on social media.

Like its physical counterpart, the Digital version is a valid ID which means it can be used in various transactions like opening a bank account and applying for other government-issued IDs, added Lumagui.

Getting the Digital TIN ID

The first step in getting the Digital TIN ID, one must access BIR’s ORUS.

But before registering on the ORUS, a taxpayer must comply with the following:

Pre-Registration Requirements (for Taxpayers with TIN)

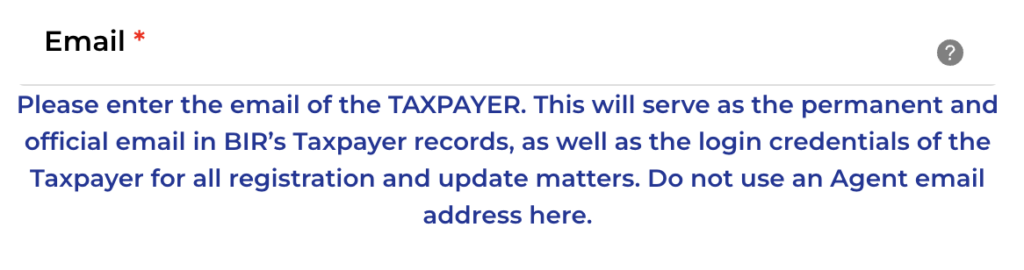

- Update Email Address: Taxpayers need to update their email address before they can successfully create an account on the ORUS.They can do so by emailing a Registration Update Sheet to their respective Revenue District Office or through BIR’s eServices – Taxpayer Registration Related Application Portal.

Registering at the ORUS

For Taxpayers with TIN

Those who have already updated their email with their corresponding RDOs may proceed in registering an account for ORUS.

- Head to ORUS

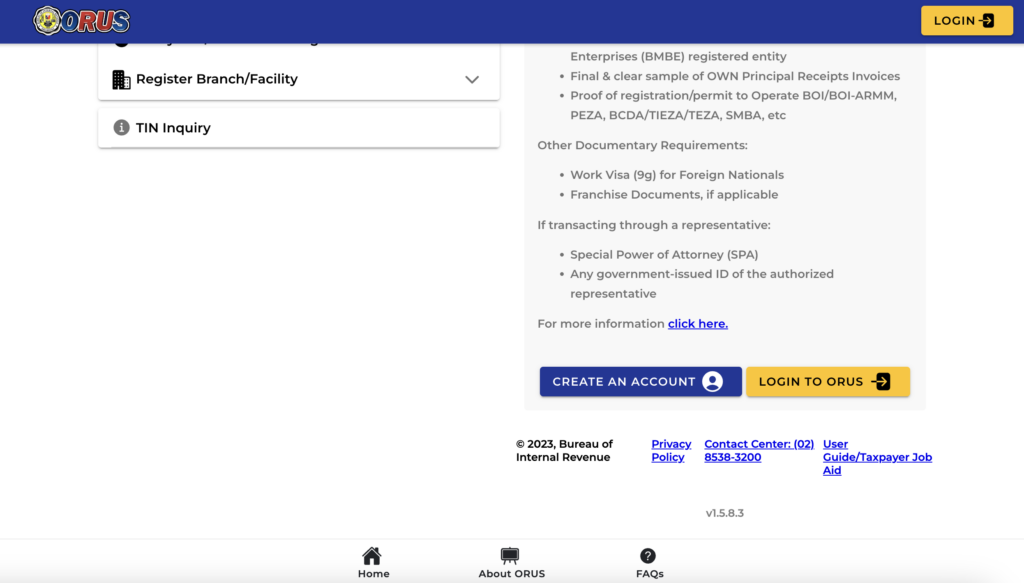

- Select New Registration: A dropdown menu will appear with As an Individual and As a Non-Individual as options. Each option will redirect users to different pages.

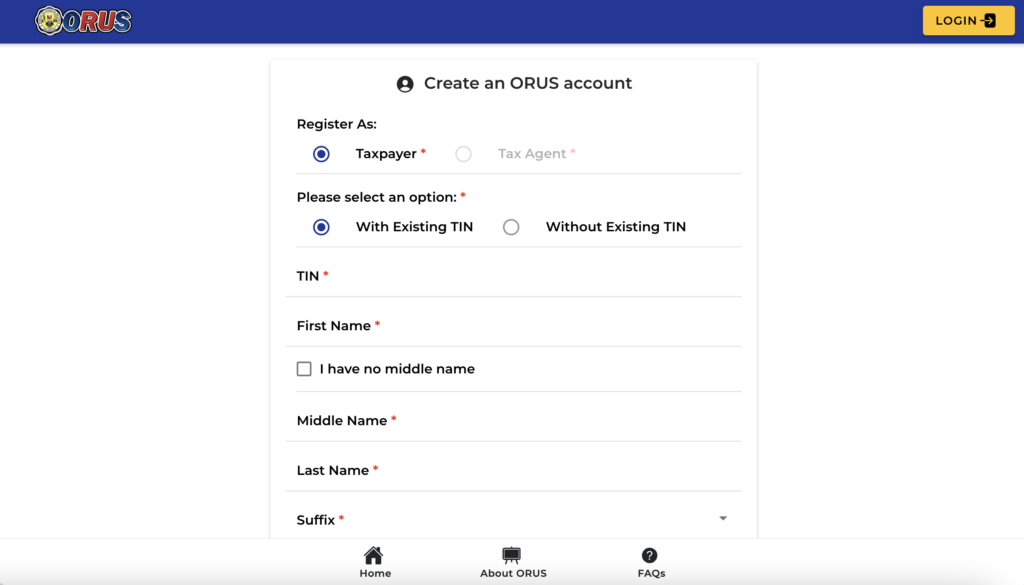

- Click Create an Account (blue tab)

- Fill in the required fields: Select With Existing TIN

- You will be asked to submit your 9-digit TIN, without dashes and the first three zeroes as well as your complete name, birth date, gender, civil status, and email address.

- Create password

- Pass CAPTCHA test

- Click Register

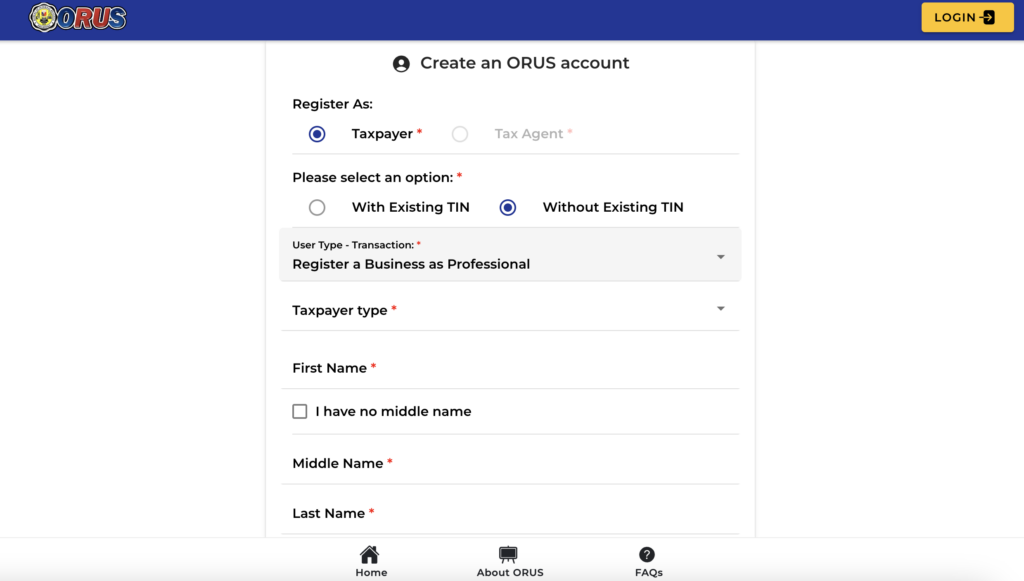

For Taxpayers without TIN

- For taxpayers who have yet to get their TIN, they can also use the ORUS to get their Digital TIN ID.

- Go to ORUS

- Select New Registration and click the option that applies.

- Fill in the required fields: Select Without Existing TIN

- Select option under User-Type Transaction

- Select the option under Taxpayer Type

- Submit name, date of birth, civil status, gender, and email

- Create password.

- Pass CAPTCHA test

- And then click Register

Important Notes

Users must submit clear photos of themselves to obtain the digital TIN ID during the process.

The BIR added that uploading unrelated images, such as photos of animals, artists, cartoons, or other photos, will result in penalties.

The Digital TIN ID

The bureau said that the said ID is a permanent document and that the physical TIN card and its digital version remain valid.

“Holders need not secure a physical card if they possess a digital TIN ID,” the BIR added.

The bureau also reminded taxpayers that the digital TIN ID is free and not for sale. / with reports from INQUIRER.net

READ:

How to renew Motor Vehicle registration

DFA to open all consular offices to walk-in passport applicants

Disclaimer: The comments uploaded on this site do not necessarily represent or reflect the views of management and owner of Cebudailynews. We reserve the right to exclude comments that we deem to be inconsistent with our editorial standards.