Cebu City Treasurer’s Office urges business owners to pay taxes, other fees before deadline

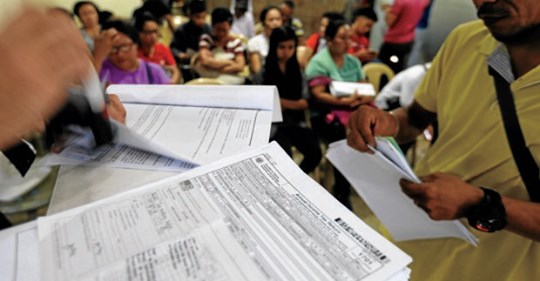

CEBU CITY, Philippines — The Cebu City Treasurer’s Office (CTO) is urging the business owners to settle their business taxes and other fees for the third quarter of 2023, on or before the deadline to avoid surcharges.

The CTO, in an advisory, announced that the deadline will be on July 20, 2023.

City Treasurer Mare Vae Reyes said that a surcharge of 25 percent and an interest of two percent per month will be imposed on the unpaid amount from the due date until it is fully paid, should the payer fail to pay business tax and other fees on or before the deadline.

Taxpayers could settle their payments at the CTO and Business Permit and Licensing Offices (BPLO) satellite office, located on the Ground Floor, Robinson’s Galleria, General Maxilom Avenue Extension, Sergio Osmeña Jr. Blvd.

The satellite office will also be opened this Saturday, July 15, to accommodate payers.

As of now, there is no advice yet if the tax payment deadline would be extended.

Earlier, the city government launched its “SAYAW para sa BUHIS” campaign against tax delinquents and to further the city’s projects and programs by funding its P50 billion annual budget.

/bmjo

READ MORE:

How to optimize Cebu City’s tax collection: Implement ‘Sayaw para sa Buhis’

Disclaimer: The comments uploaded on this site do not necessarily represent or reflect the views of management and owner of Cebudailynews. We reserve the right to exclude comments that we deem to be inconsistent with our editorial standards.