The Philippine American Life and General Insurance Company better known as the country’s premiere life insurance company AIA Philam Life, has further advanced its digitalization amid the pandemic via its 20-minute insurance process — The Coffee Closing Project.

In a virtual press conference last October 29, Kelvin Ang, AIA Philam Life Chief Executive Officer shared that this latest digital move provides customers a swift and easy way to protect their families and themselves which takes only a few minutes the same way one would finish a cup of coffee while at home.

Kelvin Ang, Chief Executive Officer of AIA Philam Life shared during the virtual conference that with a customer-centric approach to their efforts, they are able to fulfil their mission of racing against risk and helping more Filipinos live healthier, longer, and better lives.

“The pandemic served as the catalyst that pushed us to beef up our digital capabilities quickly. As soon as the physical distancing measures were put in place, we knew we had to respond with speed and ended up launching the enhanced digital selling platform (the precursor of coffee closing), our Facebook Messenger chatbot, claims and policy requests online via email, among others, within two months of the quarantine. Some of these were already in development and the situation forced us to be ready to launch as soon as possible,” shared Ang.

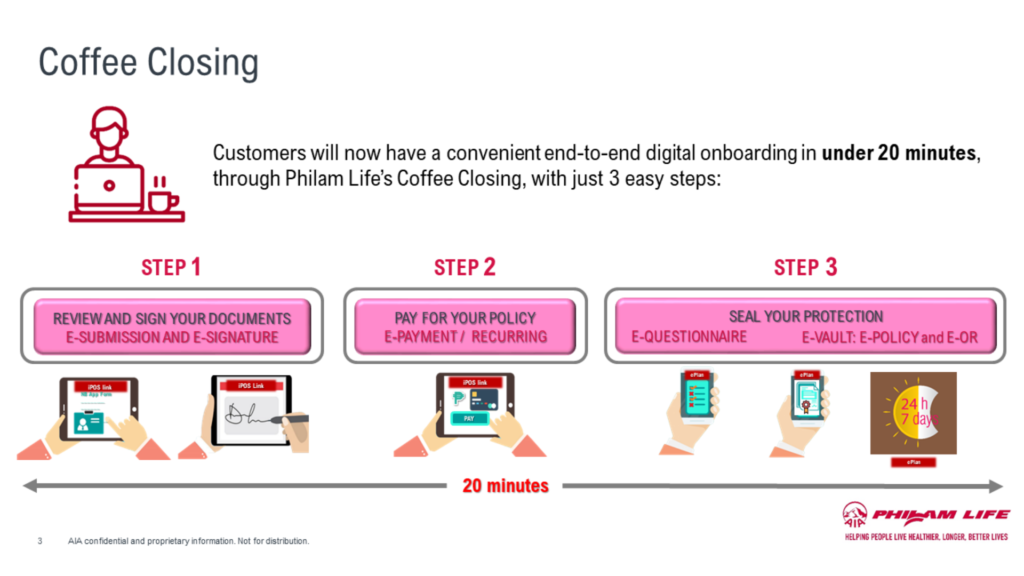

With a three-step, 20-minute process, AIA Philam Life’s Coffee Closing Project is now streamlined where clients can revisit and e-sign all their information and documents, acknowledge the agreement, pay online through debit or credit cards and get approved instantly with their own digital vault where they can read their ePolicy and more.

The Coffee Closing Project is AIA Philam Life’s latest 20-minute process application.

All of this can be done through AIA Philam Life’s iPad-based interactive Point-of-Sale (iPos) tool and a secure link provided by the financial advisor.

As AIA Philam Life transforms through world-class technology, at the heart of the Coffee Closing Project is Fusion, the first artificial intelligence (AI)-powered and award-winning digital underwriting platform in the industry. This technology helps validate insurance applications in a speedy, secure, and precise manner.

With a three-step, 20-minute process, AIA Philam Life’s Coffee Closing Project is now streamlined where clients can revisit and e-sign all their information and documents, acknowledge the agreement, pay online and get approved instantly with their own digital vault where they can read their ePolicy and more.

“Since 2012, we’ve been continuously upgrading and improving our digital platforms to make sure that our people are equipped with best in class tools that can enable them to provide a seamless experience to our customers,” said Margarita Lopez, AIA Philam Life Chief Operations Officer.

Maragarita Lopez, Chief Operations Officer of AIA Philam Life explained the easy steps to apply for an insurance with their latest innovation during the virtual conference.

Faster than the traditional procedure, Fusion is proven to process about 3,000 life insurance applications. By transcending rule-based automation and using superior cognitive automation, the system learns patterns from analyzing a hundred years’ worth of AIA customer data to bring a century’s worth of knowledge into the present.

As we slowly adjust to the new routines brought by the new normal, AIA Philam Life continues to strengthen its digital capability as the announce their digitalization as one of its strategic imperatives.

“Technology, Data and Analytics will be the driving force that will enable our plans moving forward. AIA Philam Life intends to be at the forefront and lead in digitalization for the life insurance industry,” said AIA Philam Life Chief Technology Officer Emmanuel Mendoza.

To learn more about AIA Philam Life and its products, visit their website, facebook page, or contact them through e-mail at [email protected] and call (02)8528-2000.